Exactly Which Taxes Are Going to be Eliminated?

The initiative targets the complete elimination of both commercial and residential property taxes in Michigan. This includes all taxes levied on real estate, as well as on moveable assets owned by individuals and businesses.

What exactly will happen to my local police and fire services?

The proposal addresses concerns about funding for essential local services, such as police and fire departments. It states that eliminating property taxes in Michigan will not compromise these services, as it plans to increase the state revenue share allocated to local essential services from 15% to 20%, thus ensuring your local police and fire departments continue to receive the funding necessary for operation.

What about my child’s education? We must support the schools!

Did you know that currently only 10% of school funding is paid for via your property taxes? That is a paltry $2.5 billion out of a $25 billion budget! That means that only 6 mills of your property tax dollars goes to actual education purposes. The rest of the millages are applied towards football stadiums, baseball fields, jumbotrons, and many other non-educational expenditures.

Now, we’re not saying that those things aren’t important, but we are saying that there is plenty to go around and when Michigan citizens have no property taxes weighing them and their families down, there is more to spend via community funding. Furthermore, the businesses in your community, after having been freed from their own property taxes, are going to have more to use to step up and support the extracurricular activities of the schools within your area.

I’m not a property owner, I rent… Why should I care about this?

Property taxes are a significant expense for property owners, including landlords who own rental properties. These taxes are then passed on to the renters in the form of higher rent prices. Therefore, when property taxes increase, landlords need to raise rent to cover these additional costs.

Furthermore, eliminating property taxes will encourage more investment in rental properties, leading to a greater supply of rental housing. This will help stabilize and reduce rent. And if that isn’t enough – eliminating property taxes will stimulate economic activity by increasing disposable income for property owners and renters both, which would lead to increased spending and investment in other areas of the economy.

We’ll leave you with this: Eliminating property taxes would make Michigan more irresistibly attractive to both residents and businesses. For residents, it would mean more affordable housing options [YOU could become a homeowner!].

For businesses, it would mean lower operating costs if they own property, which would lead to job creation, lower prices and economic growth.

What about business taxes?

This proposal includes the elimination of property taxes for business owners as well! This measure is expected to significantly benefit small businesses by reducing operational costs, while stimulating economic growth throughout the state by creating a more attractive environment for business investment and development.

Why should we care about businesses benefiting from this proposal? They already get tax relief!

While it’s true that some businesses receive property tax relief from the State, particularly through incentives designed to attract investment, the initiative argues that current measures are very selective and benefit only certain businesses. By eliminating property taxes for all businesses, the proposal aims to level the playing field and make Michigan attractive to a wider range of businesses, without the worry about currying favoritism based on political contributions or other factors.

This will also encourage more people to start small businesses which have always been the backbone of our great country, because they’ll have more money in their pockets for such endeavors!

Can I just read the petition text itself?

Yes! Please do read the petition for yourself. This is the best way to become familiar with our movement, and to know exactly what you will be placing onto the 2026 ballot. READ THE PETITION HERE!

Are these “essentials” worth losing your home or business for?

Some “Essentials” That Have Made Michiganders Homeless

Is Your Home or Business Worth –

A Swedish-Owned Paper Mill?

Is Your Home or Business Worth –

A Sports Stadium or Complex?

The Michigan 2025 State Budget earmarked $10 Million to Frankenmuth Youth Sports Complex, $3 Million to Berston Field House in Flint, $3 Million to West Michigan Sports Complex, $2 Million to a boxing group in Detroit, $1.5 Million for Jimmy John’s Field in Utica, $1.5 Million for a winter sports complex in Muskegon, $1 Million for the Lansing Lugnuts’ baseball stadium, $1 Million for a ski jump in Dickinson County, and also $1 Million for a midnight golf program in Wayne County. Why is the Michigan government using our hard earned money to finance for-profit stadiums?

Is Your Home or Business Worth –

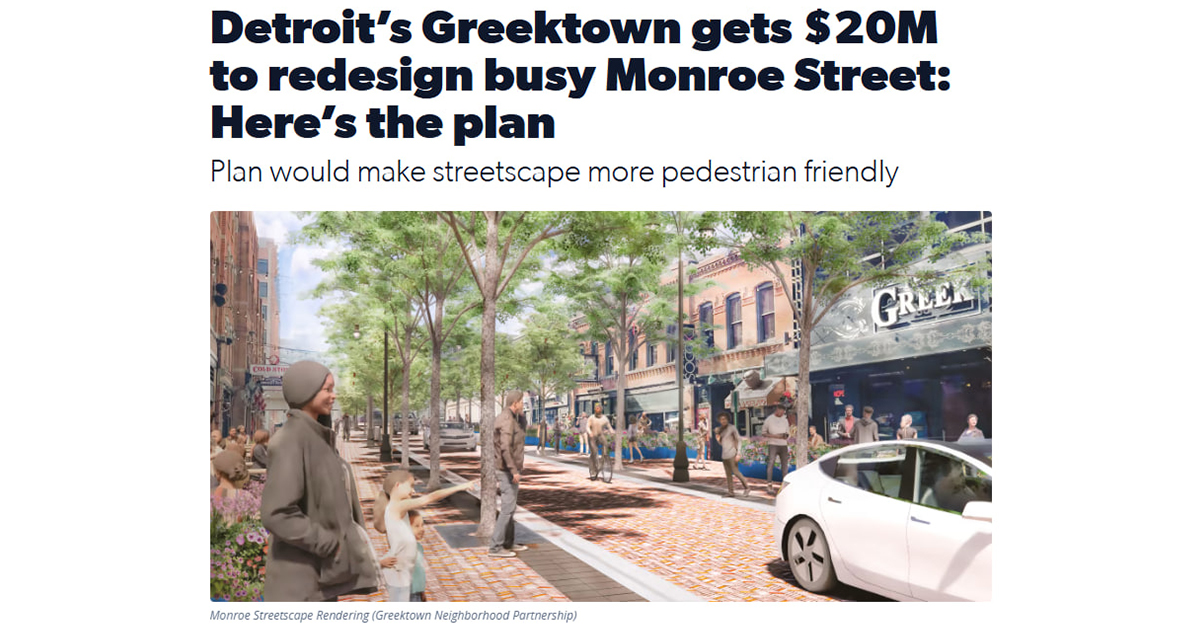

A Greektown Street Makeover?

Is Your Home or Business Worth –

A Whiskey Distillery?

Is Your Home or Business Worth –

the Warren Parks and Recreation Dept?

Is Your Home or Business Worth –

An Equestrian Center?

Is Your Home or Business Worth –

Electric Boat Chargers?

Six projects received grant funds from the State of Michigan. The MEDC announced that:

- Arc, a California-based boat manufacturer will receive

$20,000, to explore electric boating in Michigan. - Aqua superPower, will receive $111,000 to install fast marine

chargers in Traverse City, Charlevoix, and Harbor Springs. - Hercules Electric Mobility, will receive $75,000 to

develop boats with high-power electric powertrains. - Lilypad Labs, will receive $135,000 to deploy solar-powered

watercraft for public use starting in Lake Leelanau. - Michigan Technical University, will receive $50,000 to create a playbook

to determine how far people can travel in electric boats before needing to recharge. - Voltaic Marine, Inc., from Oregon, will receive $115,000 to explore

battery chemistry, propulsion, and emerging technology in Northwest Michigan.